Alternatives investments is just about anything you could’t spend money on at this time via regular 401ks or even the stock market. So anything at all that falls into stocks, bonds, and money wouldn't be regarded alternative investments.

The objective of a tax-advantaged savings account is to give you an additional financial incentive to save money for critical lifetime expenditures, such as health, training and retirement. Furthermore, several employers give company-sponsored tax-advantaged plans as An additional employee advantage.

These 3 portfolios are geared towards the tax-deferred accounts of people who find themselves still Doing work and preserving for retirement.

Besides tilting their investment portfolios closely toward stocks, people with many years until finally retirement may also reasonably maintain far more in perhaps a lot more volatile asset course subsets, which include compact-cap shares and international stocks and bonds, than those with shorter time horizons.

A closing consideration is how relaxed that you are getting risks. Do you think you're prepared to shed revenue while in the temporary, if you have the prospective to make more cash in the long term? Or would you like not to lose cash, Although you might not have just as much at the tip?

A tax-advantaged savings account provides a positive-hearth solution to decreased just how much you pay out in taxes even though expanding your very long-term savings. Based on the account you select, you can be amazed by how much you help save just by deferring or skipping taxes.

Inflation: When authentic premiums of return during the fairness, bond, or real estate marketplaces are adverse or are perceived to drop Sooner or later, individuals consistently flock to gold being an asset.

The deductibility phases out at bigger earnings concentrations when you see this page or your spouse have usage of an employer More Info system, but even without the deduction, your investments still grow tax-deferred right up until withdrawal.

Knowledge and planning for RMDs is essential for tax efficiency in retirement, as these required withdrawals may drive you into higher tax brackets or impact taxation of Social Stability Advantages.

World wide Liquidity: Precious metals are universally regarded and approved. Regardless of whether your heirs are while in the U.S. or overseas, they can easily liquidate gold or silver for money if required.

Bullion is physical metal — usually in the shape of bars or cash — which can be procured in various dimensions from just one gram upwards. It could be procured from either nearby reliable dealers or by means of online metal retailers.

Your retirement time frame should be An additional issue to help guideline the amount of hazard you would like to take on within your investments. When preserving for retirement, it’s common to take on additional danger when you’re more youthful to increase the odds that the investments will mature over the years.

Anchored in actively managed funds, these portfolios were developed with significant ESG traders in mind.

The 401(k) stands as the most typical employer-sponsored retirement approach, presenting considerable tax Gains that will radically decrease your recent tax stress though developing retirement wealth.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Nancy McKeon Then & Now!

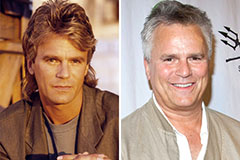

Nancy McKeon Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!